Fintech’s Next AI Upgrade: Why MCP Matters

From AI-Powered No-Code Tools to Standardised Fintech APIs, MCP Is Unlocking the Next Wave of Financial Innovation.

The way fintech products are built is changing fast.

With AI-assisted development, low-code platforms like Lovable empowering 140,000+ creators, and Model Context Protocol (MCP) standardising how AI interacts with financial data, we’re entering a new era where fintech services can be built in hours, not months.

In this article, we’ll cover:

❌ Why AI-driven development (aka vibe coding) is making fintech faster to build than ever.

➡️ How MCP is creating a universal standard - allowing AI to interact with banking, payments, and financial data seamlessly.

🔎 Why fintechs and digital banks that offer AI-friendly APIs will dominate the next wave of financial services.

📱 How fintech tools like Block, Sardine, and Stripe are already integrating MCP to future-proof their platforms.

✨ The massive opportunity for fintechs to become the go-to API layer for AI-powered finance.

How the Next Fintech Products Will Be Built

Andrew Chen is one of my favourite long-form writers on tech startups, growth, and network effects.

(📖 If you haven’t yet, check out his book The Cold Start Problem - see my book review here)

His latest article on vibe coding - the new wave of low-code, AI-assisted product building - is eye-opening for anyone interested in how fintech and tech at large will evolve in the coming years.

In my previous article on Klarna, we saw how a Stripe product manager was able to re-create DocuSign functionality in less than 2 days, using AI tools alone.

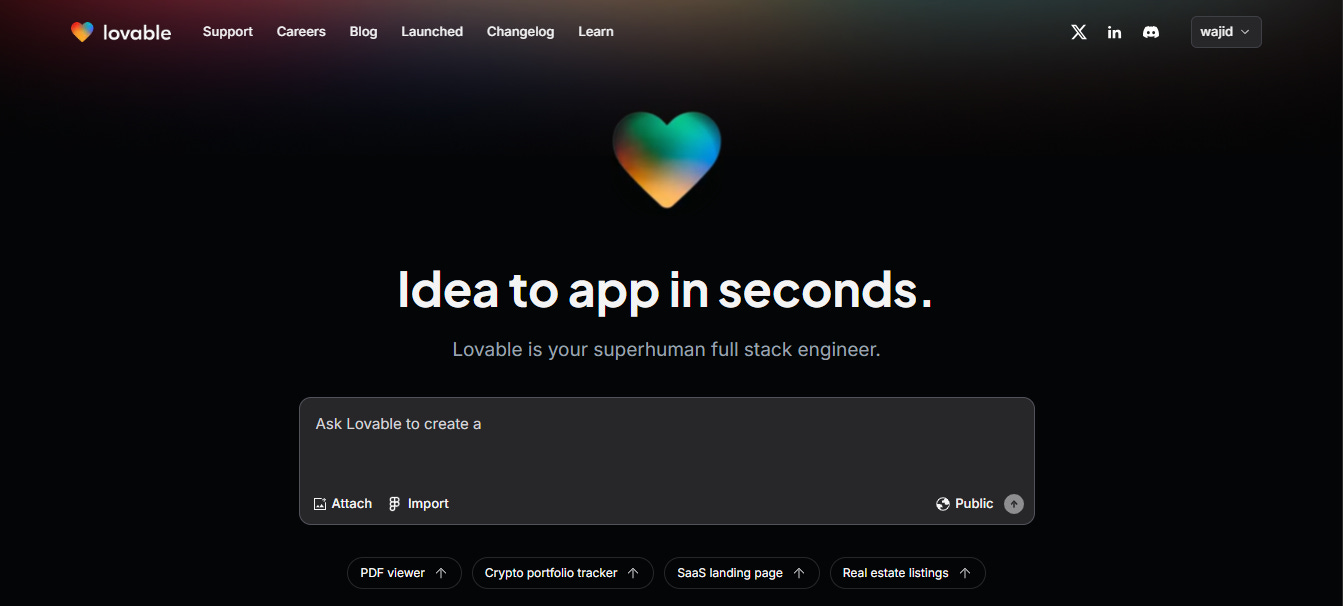

New platforms are emerging too - like Lovable, a small Swedish startup that has already empowered 140,000+ product builders to create apps they never thought possible.

The Next Big Thing Will Look Like a Toy

Andrew often says the next big thing will start off as something playful, embraced by the time-rich - kids & students.

A generation that has never been told “that will never work”, unafraid to experiment, now equipped with AI as their sidekick.

This will spark new trends, new UX patterns, new product paradigms

And the transition is already underway.

From Vibe Coding to Vibe Designing

If “coding” in vibe coding sounds intimidating - don’t worry.

Andrew predicts a shift from code-based AI to design-driven AI.

We already see this happening with tools like Lovable, where the focus shifts from writing code to visual design and interaction logic.

But There’s a Problem

Building with AI today still has frustrating limitations:

Buggy code

AI hallucinations

Outdated knowledge

APIs breaking overnight

Enter Model Context Protocol (MCP)

Developed by Anthropic (Claude AI), MCP is a new open standard that makes AI models actually useful.

Think of MCP as USB-C for AI - a universal way to connect AI models to real-world systems, customer data, and APIs.

This isn’t just an AI breakthrough.

It’s about interoperability - and how the next wave of fintech products will be built.

Fintech tools at speed

A few years ago, adding financial services to a digital product meant months of engineering effort.

Now? You can spin it up in hours, with AI generating interfaces, workflows, and logic on the fly.

AI + APIs = Instant Fintech Services

Beyond AI-generated code, the heavy lifting is done by leveraging fintech APIs - handling payments, lending, identity verification, compliance, and more.

The new MCP standard is pushing fintech integrations even further, enabling extreme precision when connecting APIs.

In payments for example, Stripe became the go-to for vibe coders because it offered the cleanest APIs and integrations.

Now, any tool built on Lovable defaults to Stripe because it’s the path of least resistance.

The same pattern will repeat in AI-integrated fintech services - whichever fintechs and digital banks make their MCPs and APIs developer-friendly will skyrocket in adoption

MCP + APIs = The New Fintech Stack

I’m going to try to not get too technical here so bear with me :)

With MCPs enabling AI to interact with financial data in real time, digital banks and fintechs need to focus on two things:

1. Building out their MCP infrastructure - Making sure AI agents can access account data, transactions, and financial actions securely and efficiently.

2. Creating fintech APIs that fit seamlessly into vibe coding stacks - Becoming the Stripe of lending, wealth management, embedded finance, or fraud prevention.

We’re now seeing tools become integral to developer stacks because they offer this interoperability. If a fintech or bank wants to be part of this ecosystem, it needs to be plug-and-play for AI models and builders.

Who’s Already Doing This?

• Block (Square) is integrating MCP into its fintech stack, paving the way for AI-driven payments, commerce, and financial tools.

• Sardine built an MCP-powered AI assistant that helps developers integrate fraud detection APIs in seconds.

• Stripe’s early MCP connectors show its positioning for the next wave of AI-driven payments.

Beyond these, the open-source community has created a growing list of MCP servers for finance-related functions. There are connectors for cryptocurrency data and blockchain interactions (CoinMarketCap, Dune Analytics, Ergo blockchain, etc.) , enabling AI agents for trading or DeFi use cases. One developer even demonstrated an AI trading agent that uses MCP to read market forecasts and execute trades via a crypto exchange – all through standardized MCP calls . This shows how digital asset platforms are testing MCP for autonomous financial agents.

The Opportunity for Fintechs & Digital Banks

Fintechs that move early on MCPs and APIs will become the default choice for:

Vibe coders

AI product builders

The next generation of fintech startups

Why MCP is a Game-Changer

If your MCP-enabled banking API is the easiest to integrate, builders will use it.

If AI agents can seamlessly access your financial services, your adoption will skyrocket.

MCP streamlines system architecture for AI-powered banking and scalability.

MCP: Standardising Fintech AI Integrations

AI remains decoupled from complex data source integrations.

New tools or data sources can be added without altering AI clients.

Reduces duplicate effort, making systems more extensible.

Multiple AI models can share the same MCP connectors- enabling easy switching between AI vendors.

For fintechs & digital banks, adopting MCP isn’t just an option - it’s an opportunity to lead the next wave of AI-powered financial innovation.

Enhanced Customer Experience

For digital bank and fintech customers, MCP enables AI to be smarter, more contextual, and proactive - delivering a seamless, concierge-like experience.

AI That “Remembers”

Today, bank chatbots forget past interactions.

With MCP, AI remembers context, creating fluid conversations.

No more repeating information - AI builds on prior interactions.

Real-Time, Proactive AI

AI can pull live financial data (balances, bills, loan rates, investments) instantly.

Example: Ask, “Can I afford to save more?”- AI checks balances, bills, and interest rates to give a tailored answer.

AI acts like a personal financial assistant - not just a basic Q&A bot.

Multi-Step Financial Workflows in One Command

“Pay my bills, credit card, and send the rest to savings.”

Today: Requires multiple steps & manual work.

With MCP: AI orchestrates everything in one seamless flow.

AI can handle banking, payments, budgeting, and transfers in a single interface - zero friction for users.

The Future of AI-Driven Fintech

MCP empowers fintechs & digital banks to offer:

✔️ Smarter, context-aware AI assistants

✔️ Fewer user frustrations & repetitions

✔️ Hyper-personalised, real-time financial insights

✔️ A single AI-driven experience across all financial tasks

Fintechs that embrace MCP will set a new standard for AI-driven financial services.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.