Inside Klarna’s AI-Powered SaaS Breakup

How Klarna is Replacing 1,200 SaaS Tools, Reshaping Its Tech Stack, and Becoming an AI-Driven Bank.

AI is everywhere. Every company is scrambling to sprinkle AI into their products, and fintechs are no exception. But while most are just riding the hype, Klarna is making a fundamental shift, not just adding AI features, but rebuilding its entire organisation around it.

Last year, Klarna’s CEO, Sebastian Siemiatkowski, made a bold claim: Klarna would become the most efficient AI-driven bank. A year later, they’ve backed it up, cutting half their workforce, shutting down 1,200 SaaS tools (including Salesforce), and building a custom AI-powered internal stack.

This isn’t just about cost-cutting. Klarna is proving that the future of software isn’t buying more tools, it’s building exactly what you need, powered by AI.

In this article, we’ll break down:

❌ Why Klarna ditched major SaaS platforms like Salesforce and Workday.

➡️ How Klarna is leveraging AI to unify data, automate workflows, and boost efficiency.

🔎 The reality of replacing enterprise SaaS - what’s possible, what’s not, and where AI falls short.

⚖️ The Pareto Principle of SaaS: Why 80% of features aren’t needed - and Klarna is only building what it actually uses.

🛠️ The future of Buy vs Build: Why AI is shifting the balance towards in-house solutions.

✨ What this means for fintechs, enterprises, and the future of AI-driven companies.

one-fs x Dubai AI Festival

Another major partnership secured for one-fs! 🕺🚀

The Dubai AI Festival, happening on 23-24 April 2025, is a flagship AI event bringing together:

🦄 20+ global unicorns revolutionising industries with cutting-edge AI innovations

🌎 20+ government agencies/ministries collaborating to drive AI adoption in governance

💼 20+ global enterprises presenting transformative AI solutions

💵 20+ top venture capitalists exploring AI investment opportunities

It’s an honour for one-fs to be selected as a partner for this event, organised by the Dubai AI Campus, in collaboration with the DIFC and the UAE’s Minister of State for Artificial Intelligence.

I’m particularly excited about this event’s strong AI & Fintech focus - two of my key areas of interest. Stay tuned for exclusive insights!

Inside Klarna’s Great SaaS Transformation

There’s a lot happening in AI right now - and while I’m fully immersed in experimenting with it (having daily Aha moments), I try to cut through the hype instead of cluttering your inbox with yet another AI article.

Every company is sprinkling AI dust on their products to stay relevant. Fintechs and banks are no exception - they’ve jumped on the AI bandwagon, contributing to the noise.

But amidst all this, Klarna is making a huge strategic shift, moving from a BNPL giant to a AI-driven Bank. Let’s break it down.

The most efficient AI-driven Bank

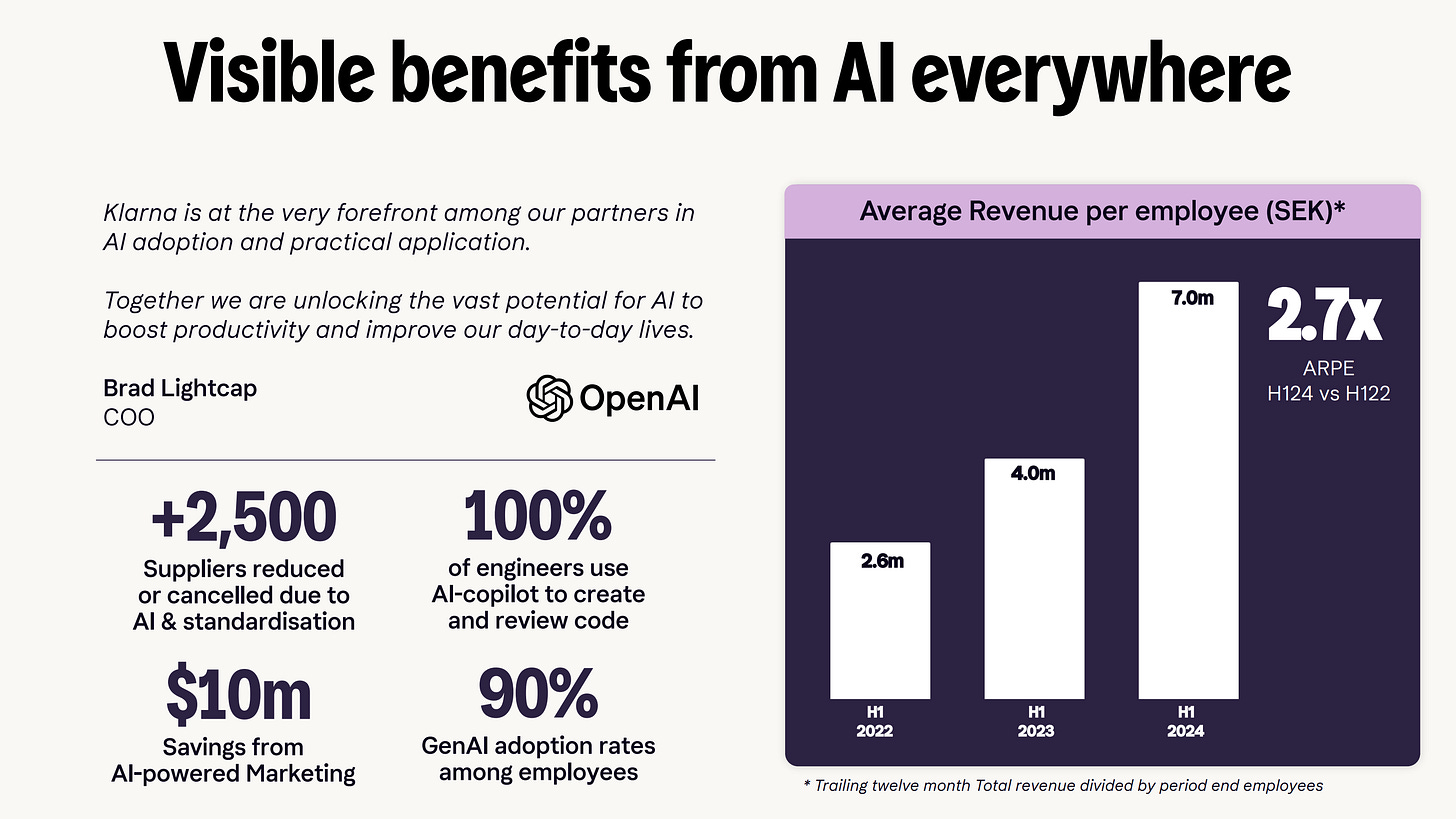

Klarna made waves when CEO Sebastian Siemiatkowski announced last August that they would cut half of their workforce, reshaping their tech stack with AI to become the “Most Efficient AI-Driven Bank.”

Bank, you say? Yes. In case you didn’t know, Klarna has been a fully licensed Swedish bank since 2017, regulated by the Swedish Financial Supervisory Authority (Finansinspektionen).

While Klarna is widely known as the leader in BNPL (Buy Now Pay Later), their long-term vision is to transition into a fully-fledged global digital bank.

I expect we’ll hear a lot more about this soon, as Klarna is rumoured to go public on the New York Stock Exchange as early as next week.

What did Klarna actually do?

When Klarna announced its AI-driven transformation, major news outlets either:

Focused on fear-mongering (“AI is eating jobs,” “Salesforce is dead,” etc.)

Dismissed it as just another AI hype story

Speculated that Klarna couldn’t possibly replace major SaaS tools like Salesforce or Workday

But this week, CEO Sebastian Siemiatkowski took to X to set the record straight and share real details on what Klarna has actually achieved over the past year.

➡️ Shut Down 1,200 SaaS Tools – including Salesforce, not for cost-cutting, but to unify and standardise knowledge across the company.

➡️ Built the underlying AI foundation – one of the most important aspect to ensure a unified approach and stack.

➡️ AI & LLM Exploration – encouraged employees to experiment with AI early, recognising the importance of data quality over just feeding everything into an LLM.

➡️ Knowledge Consolidation – mapped out valuable vs. redundant data and used graph databases (Neo4j) to connect and visualise information.

➡️ Internal Tech Stack Development – built a system to unify data, reducing silos and improving productivity rather than simply replacing SaaS with AI.

➡️ Leveraged AI for Productivity Gains – integrated AI to interact with their internal knowledge base, enhancing efficiency.

Are Salesforce and other SaaS tools replaceable?

The debate over whether SaaS giants like Salesforce will vanish in the AI era is heating up.

The defenders: Industry veterans argue it’s naïve to think these platforms can be easily replaced. Companies like Salesforce have years of deep industry expertise and complex back-end infrastructure that isn’t visible on the surface.

The challengers: AI optimists and technologists love proving otherwise. Just this week, Michael Luo, a Stripe product manager, built a DocuSign clone in just 2 days using ChatGPT, Lovable, and Cursor.

Jensen Huang (Nvidia’s CEO) believes that Salesforce is sitting on a goldmine of data, ready to be supercharged with AI, not replaced. He predicts these SaaS platforms will grow even bigger, with AI unlocking their full potential - with Nvidia at the heart of it, of course 😉.

As for me? I’m always experimenting with AI’s potential - read more on my AI experiments below👇

Now, the reality is much more nuanced.

No, Michael Luo didn’t replicate the entire DocuSign SaaS - far from it.

What he built was a functional prototype that mimicked DocuSign’s core feature:

An interface to upload a document

The ability to mark signature, name, and other required fields

A workflow that sends the document via email, gets it signed, and returns it to the sender

Impressive? Absolutely (Check it out here). But replacing enterprise-grade SaaS like DocuSign is a whole different game. Scalability, security, compliance, integrations, and advanced workflows are what make these platforms moat - for now.

The missing pieces

While replicating core SaaS functionality with AI is impressive, there’s a big gap between a simple prototype and a fully-fledged enterprise SaaS like DocuSign.

Compliance & Security:

Enterprise-grade SaaS platforms invest heavily in regulatory compliance, security, and legal frameworks. DocuSign, for example, holds 16 certifications, including PCI DSS, SOC 1 & 2, ISO 27001, 27017, and 27018.

These aren’t just checkboxes, they’re critical for large enterprises and can’t be whipped up overnight by generative AI.

The Context Window Limitation:

Most AI models still operate within limited context windows - the memory space they use to understand and generate responses. While newer models like Gemini Flash offer larger context windows, scaling beyond simple UI and workflows remains challenging.

Workarounds Exist:

Breaking complex applications into modular components

Leveraging existing standards, libraries, and documentation

Combining multiple AI models and agentic workflows

While AI isn’t replacing Salesforce or DocuSign overnight, it’s changing the way software is built - and that shift is already happening.

Build what you need - The Pareto Principle

Replicating DocuSign to compete with them isn’t the point. Companies like Klarna don’t need to build a full SaaS product, they just need to build what they actually use.

Why?

❌ No need to develop sales & marketing functions

❌ No need for customer support, admin, infra & hosting

❌ No need to build every feature designed for millions of users across 180+ countries

Instead, they focus only on what they need, which as you’ll read below, is likely just a small percentage of the overall product.

The Pareto Principle (80/20 Rule)

80% of SaaS users rely on just 20% of the features. The remaining 80% of features are only used by power users or niche customers.

Here’s a real example from my own experience this week:

I needed a video compression tool, available from a leading SaaS provider for $300/year per user.

Curious, I asked ChatGPT how difficult it would be to build the same feature. 10 minutes later, I had:

✅ A fully functional video compression tool

✅ Running locally on my Mac (faster & safer, no cloud uploads)

✅ 100% free

✅ Seamless interoperability with my workflows

And this is exactly what Klarna is doing, but at a massive scale, across their entire organisation.

Hyper-personalisation of everything

For Klarna, this shift isn’t just about cost-cutting (though with over 1,000 SaaS tools, they’re saving millions at the very least).

The real advantage?

✅ Unified data across the organisation

✅ Privacy & security (on-premise + open-source LLMs like DeepSeek or Llama)

✅ Speed and seamless internal workflows

✅ Hyper-personalisation of everything

Tailor-Made Beats Off-the-Shelf

No matter how much SaaS companies promise, the reality is:

They use different tech stacks, clouds, processes, workflows, and architectures

Integration takes significant effort & cost

Even with full integration, you’re still limited by their constraints

For tech-savvy companies like Klarna, the Buy vs Build decision is shifting heavily towards Build.

❌ Will Salesforce disappear? Unlikely. As Jensen Huang said, AI could propel even them to new heights.

✅ Is Klarna’s strategy for everyone? No. Many companies will stick with SaaS, some lack the talent, others fear opening Pandora’s box.

🚀 But those who embrace this shift today, like Klarna, will gain:

➡️ Next-level operational efficiency

➡️ More value delivered to customers

➡️ Lower costs in the long run

To me, it’s a no-brainer.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.

Klarna shutting down 1,200 tools including Salesforce proves what I've been telling banking clients for years - we're drowning in bloated features we never use.