Robinhood’s Masterclass: How to Expand from Fintech to Banking

From AI-Powered Investing to a Private Banking Experience - How Robinhood Gold Is Reshaping the Future of Digital Finance.

Robinhood just pulled off one of the most strategic fintech expansions we’ve seen lately, moving into full-service banking.

At its second annual keynote, The Lost City of Gold, CEO Vlad Tenev and the Robinhood team unveiled their biggest product launch yet:

✅ Robinhood Strategies - AI-powered investment management at a fraction of the cost of traditional advisors.

✅ Robinhood Cortex - An AI-driven research assistant that filters market noise and helps users make smarter trades.

✅ Robinhood Banking - A full digital banking experience, complete with 4% APY savings, joint accounts, transfers & remittances, real-time net worth tracking, and even on-demand cash delivery.

In my view, it’s a masterclass in how to make banking an extension of an existing fintech product.

In this article, we’ll break down:

🏦 Why Robinhood’s shift into banking isn’t a pivot, but a natural evolution.

🔑 How Robinhood Gold turns a simple subscription into an entire financial hub.

🤖 Why AI-powered investing and research are key to making banking services more engaging.

📱 How Robinhood is replicating the private banking experience for the masses - and what that means for the future of fintech.

✨ The blueprint for how fintechs can expand beyond transactions and into full financial relationships.

Robinhood’s Masterclass: Expanding from Fintech to Full-Service Banking

This week, Robinhood hosted its second annual keynote, The Lost City of Gold, with a distinct Indiana Jones feel - recorded live at the historic San Francisco Mint. Against the backdrop of a building that once held a third of the U.S. gold reserves, Chairman and CEO Vlad Tenev, along with Robinhood’s leadership, unveiled the latest AI-driven tools and banking services shaping the future of Robinhood Gold.

More than just product launches, this event was a masterclass in how a fintech can successfully expand into banking.

With the introduction of 2 AI agents: Robinhood Strategies (Investment Advisor) and Robinhood Cortex (Research assistant), and a new banking product suite, Robinhood is setting a new standard for AI in fintech and the future of digital banking.

At the heart of it all is Robinhood Gold, their $5/month premium subscription service, now evolving into a full financial ecosystem, seamlessly integrating investment management, research, and banking under one subscription.

Here’s how Robinhood is reshaping the financial landscape - and why this might be its most ambitious move yet.

Robinhood’s Vision: Bridging Two Financial Systems

Vlad Tenev started the keynote by framing how traditionally, finance has been divided into two systems:

One for the wealthy, who have access to financial teams, advisors, and exclusive services.

One for everyone else, where financial tools are often limited, expensive, or inefficient.

Robinhood’s vision is to remove this gap by digitising and scaling the private banking experience - something no one has successfully done before (according to Vlad).

Through AI, they are introducing three 24/7 financial experts that replicate the services of the ultra-wealthy but make them available to all users: a research investment, an investment advisor and a private banker.

1. Robinhood Strategies - Your AI-Powered Investment Advisor

Many customers want hands-off portfolio management with low fees.

But the wealthy typically have investment advisors who require six or seven figures in assets just to work with them.

Robinhood Strategies democratises this by making professional-grade investment management available to everyone - whether they have $50 or $50M.

A hybrid approach: Combines the best of human expertise and technology to anticipate investment questions before they are asked.

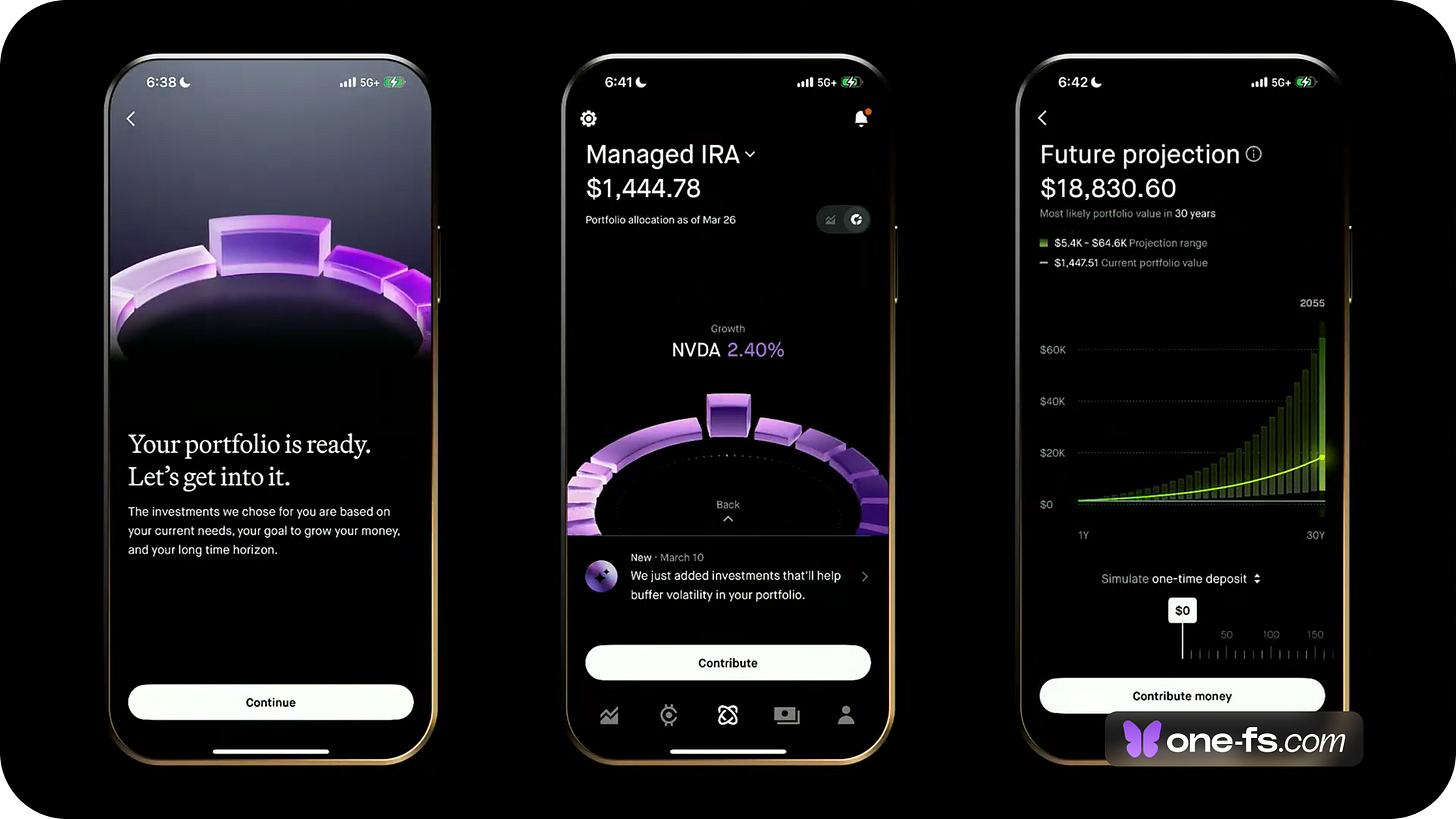

Another cool feature is the FUTURE button, that uses real-time data to project the true path of returns over time - not just a simple compounding tool.

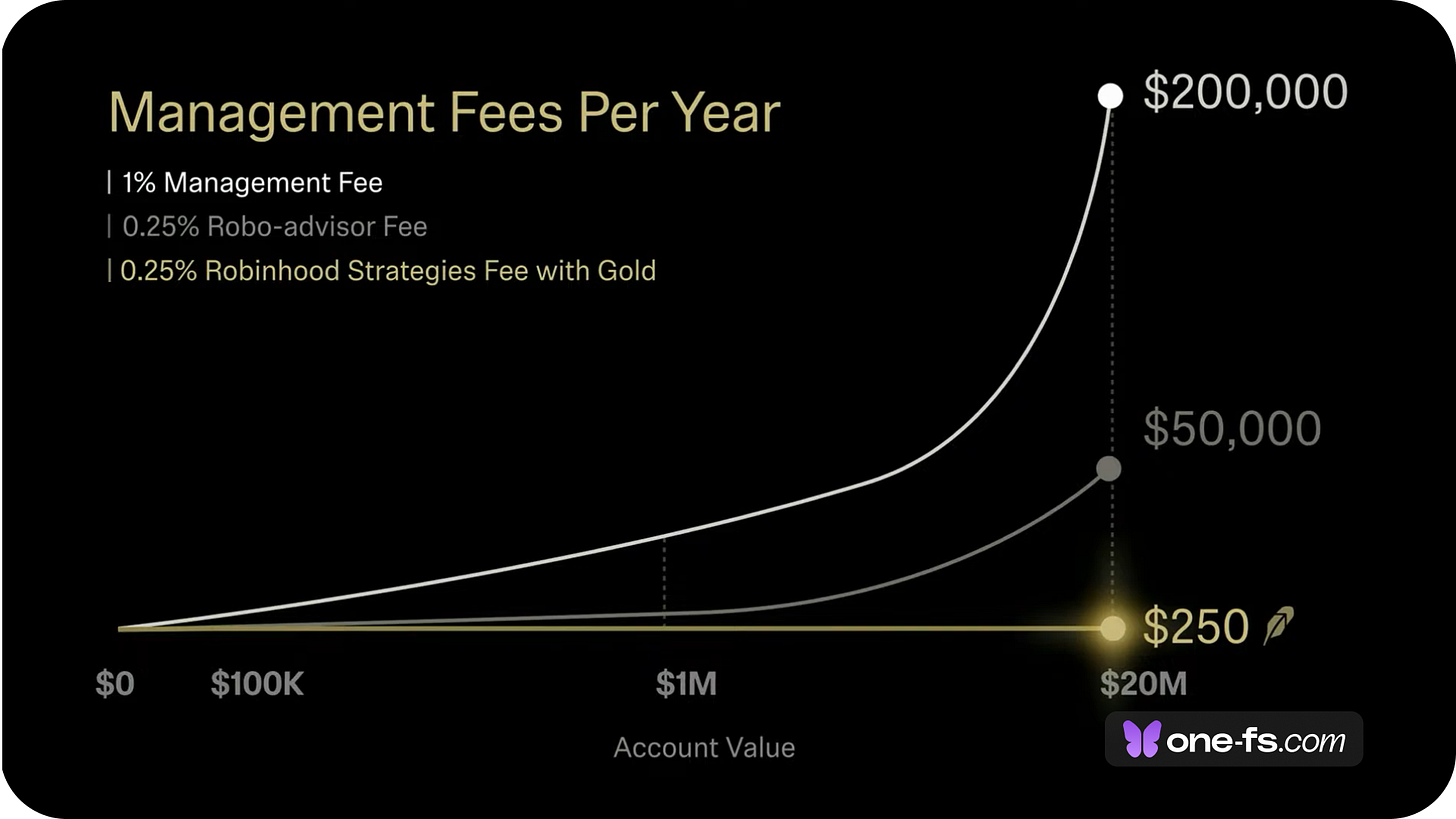

➡️ But here is the game changer: ultra-low management fees at 0.25% AND capped at $250 per year for Gold members - a game-changer for investors managing over $100K.

According to Steph Guild, Robinhood Strategies President, the offering goes far beyond the traditional robo-advisor model which is easy & low cost but provides generic portfolios of etfs and mutual funds without much guidance or explanation.

Robinhood Strategies is available now live for Robinhood Gold members.

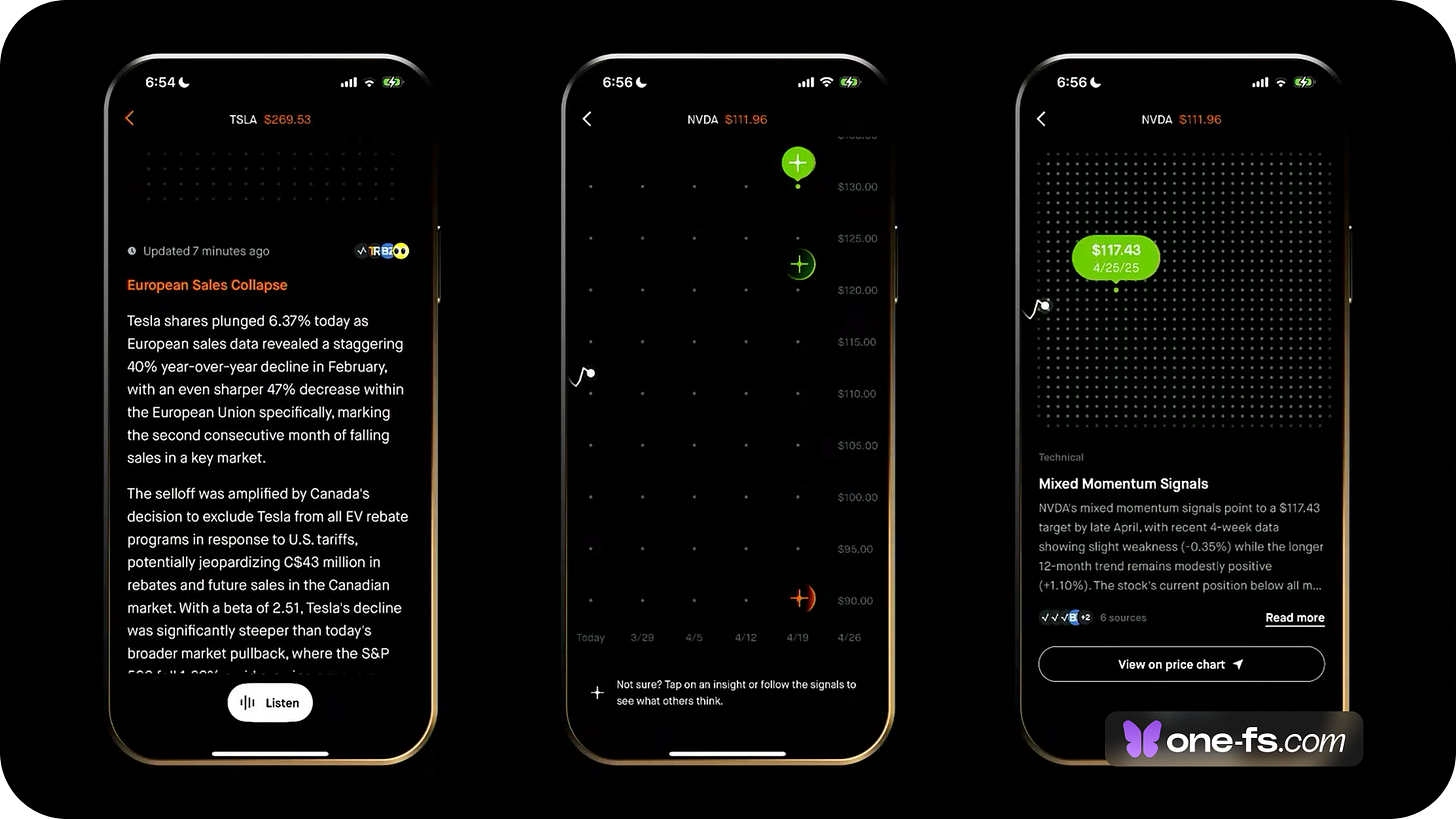

2. Robinhood Cortex - Your AI-Powered Research Assistant

Access to high-quality market intelligence, available 24/7.

It filters out noise - delivering only valuable investment signals.

It’s focused on solving the most complex pain points in options trading.

How it works

Data aggregation: Combines top resources, such as Options, Futures & Other Derivatives, with real-time market trends, breaking news, company fundamentals, and investing behaviour.

Stock Digest: Instant, AI-generated explanations for why a stock has moved.

Trade Builder: Helps construct options trades step-by-step with AI assistance. The UI Robinhood created for this feature is truly unique 👌

Side-by-Side Options Chain: A new way to fine-tune trading strategies.

Robinhood Cortex is Free for Gold members.

3. Robinhood Banking - Your Digital Private Banker

Here comes the main event. Robinhood declared that private banking is no longer reserved for the ultra-wealthy.

Robinhood Banking is built by the same team behind the Robinhood Gold credit card (Siddharth Batra & Deepak Rao).

The experience

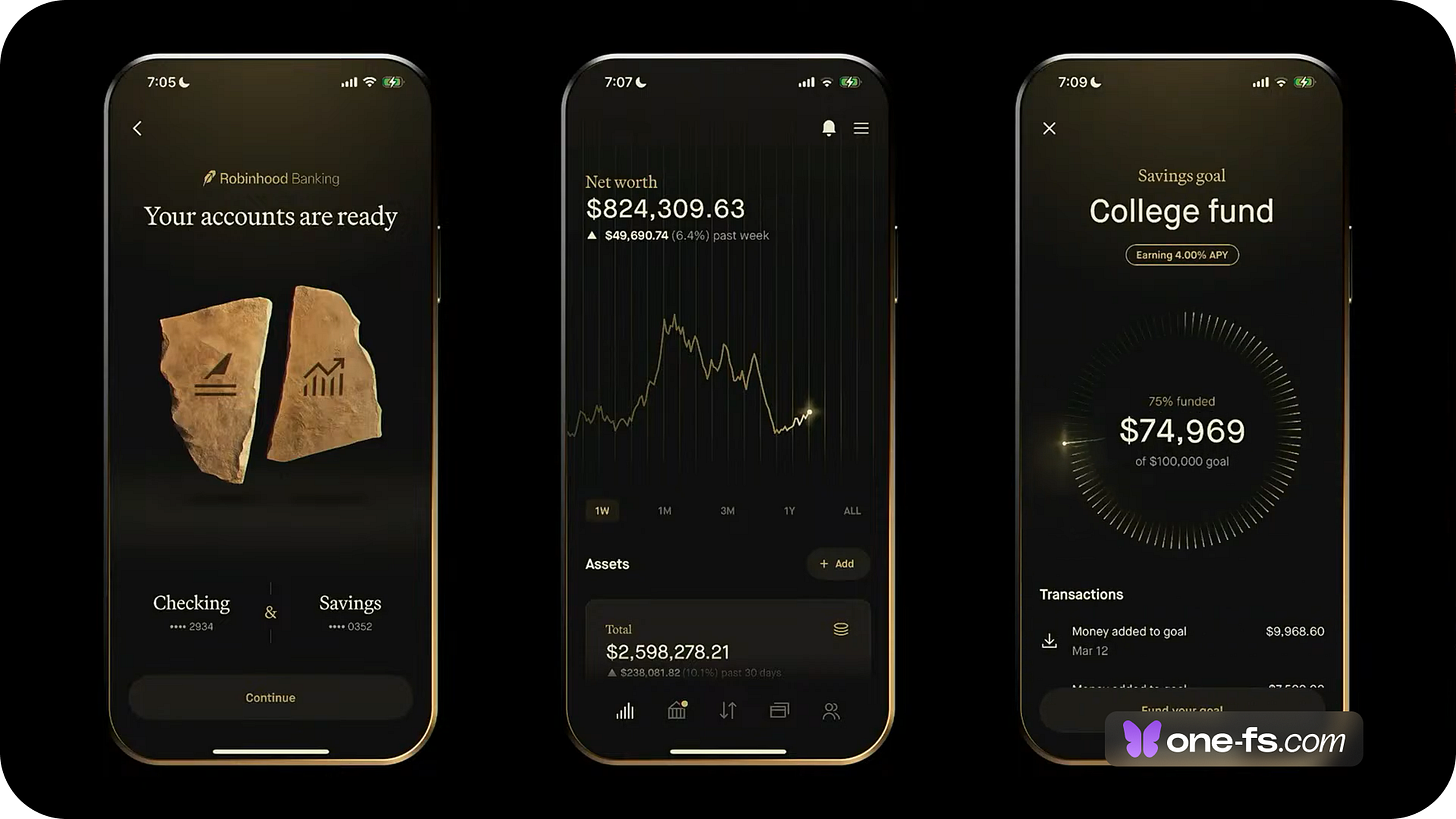

Instant onboarding: Existing Robinhood customers can open accounts in seconds, including the ability to move their direct deposits instantly.

Live net worth tracking: Includes real estate, stocks, savings, and liabilities - all in one seamless view.

Joint accounts: Designed for spouses and families with savings goals (4% APY!)

Trust creation: Set up a family trust directly in the app.

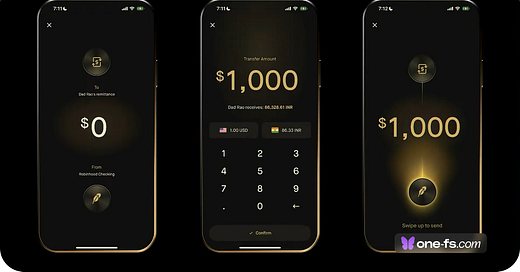

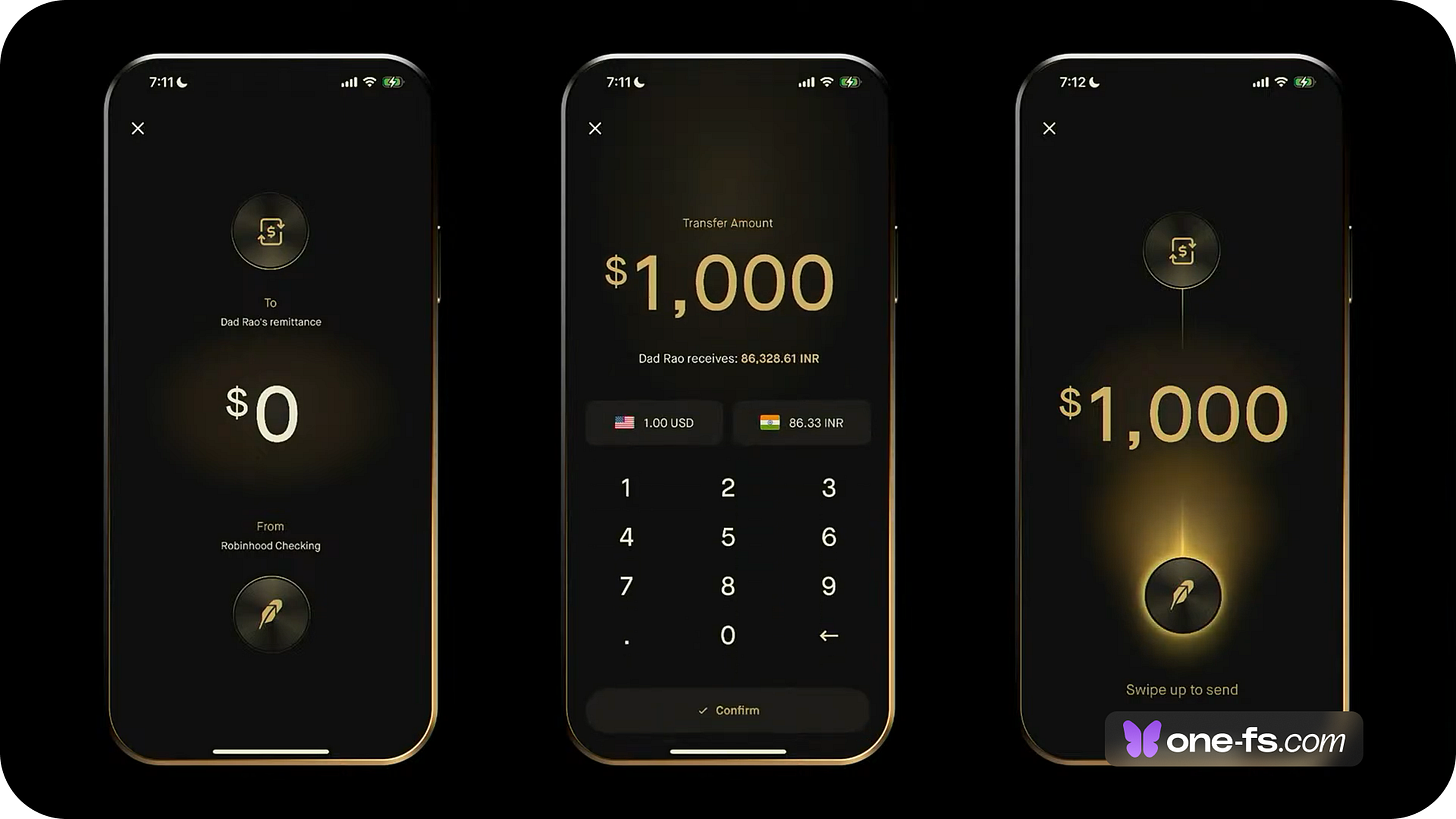

Money transfers: A beautifully simple, fast, and smooth experience. I love the swipe up experience 👌

Exclusive perks: Members get access to premium experiences (e.g., Met Gala, Formula 1, Coachella).

On-Demand Cash Delivery - Cash That Comes to You, as easy as ordering Uber or Postmates. A really cool feature - hopefully well thought through in terms of security.

A special mention to the UI of the Robinhood Banking experience. I love the dark mode and its distinct look. The Indiana Jones - Lost City of Gold theme might age quickly, but it’s well-crafted and, more importantly, serves as a consistent visual reminder of the private, exclusive feel they aim to provide.

Robinhood Banking is set to launch Q3 2025.

Robinhood Gold - The Power of Subscription Economics in Fintech

A Genius Model: The $5 Per Month “No-Brainer” Subscription

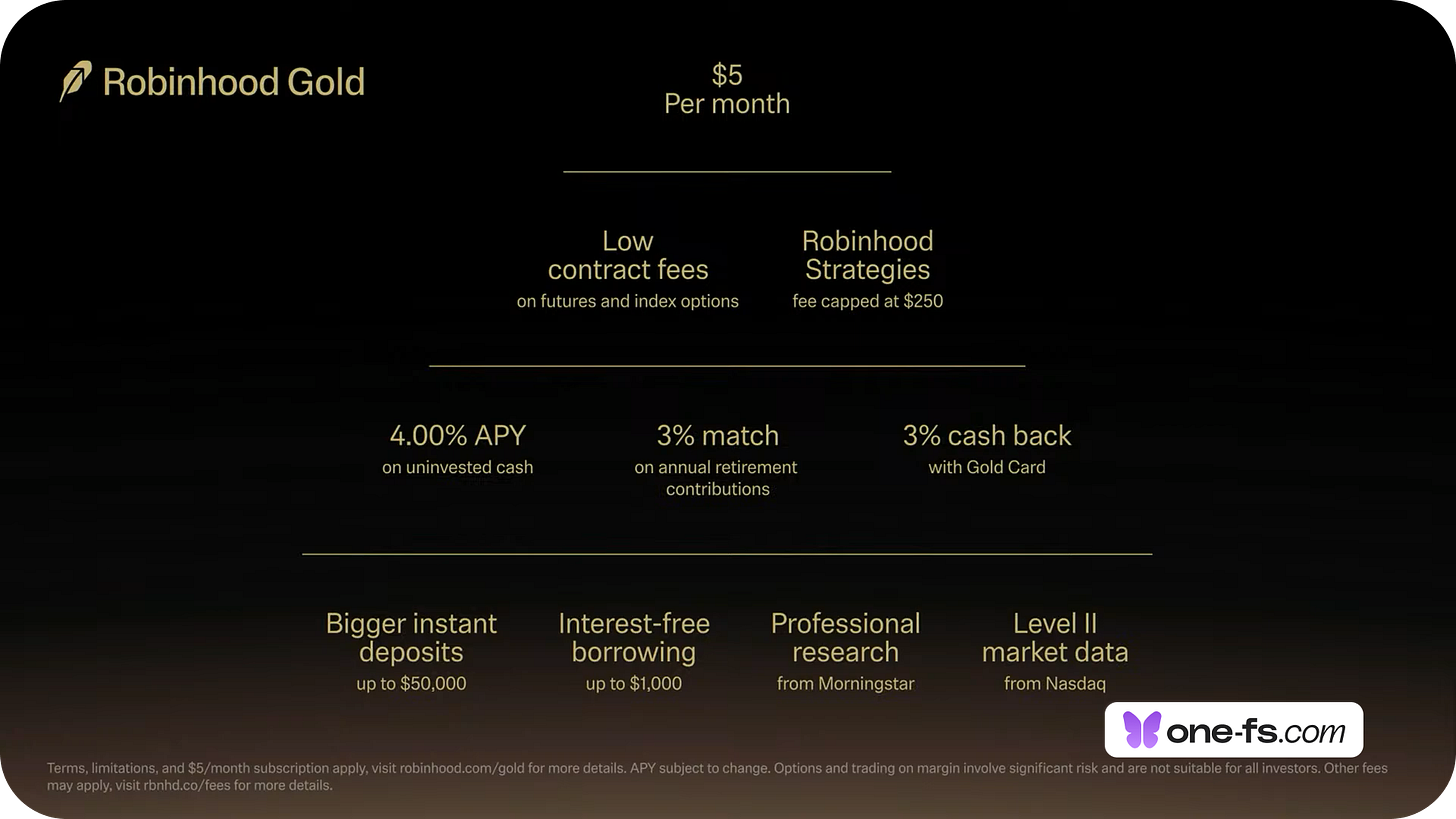

Robinhood Gold is a smart fintech growth strategy. At just $5 per month, the price is low enough that users barely notice it, making it an easy, low-friction decision.

However, once subscribed, users gain access to premium financial tools that entice them to consolidate their finances within Robinhood, ultimately increasing their engagement and lifetime value.

Traditional banks and investment firms rely on transaction fees, advisory percentages, or account minimums to make money. Robinhood flips this model, making financial services accessible at a flat, predictable cost.

➡️ Low Price = No-Brainer Signup with Unmatched Value

$5/month feels negligible compared to traditional advisory fees.

Wealth management is expensive elsewhere: Professional advisors typically charge 1% of assets under management, meaning a $50K portfolio costs $500/year in fees.

Robinhood Strategies under Gold caps management fees at $250/year.

The combination of low cost + premium service makes Robinhood Gold an obvious choice for investors.

➡️ More Features = More Engagement

Gold unlocks exclusive access to:

Robinhood Strategies (AI-powered investment advisor)

Robinhood Cortex (AI-driven research assistant)

Robinhood Banking (full-service digital banking)

Robinhood Gold Card (3% cashback, luxury perks)

Once inside the ecosystem, users begin leveraging more financial services, reinforcing loyalty and stickiness.

➡️ Gold Becomes the Gateway to Full Financial Management

Here’s a typical journey:

A casual trader subscribes to Gold for lower trading fees.

They try Robinhood Strategies, automating part of their portfolio.

They see value in passive investing, leading them to move more funds into Robinhood.

Eventually, they start using Robinhood Banking, integrating direct deposits, savings, and bill payments.

Over time, Robinhood transitions from an investing app to their primary financial hub.

Robinhood Gold grew from 1.5M Gold subscribers to 3.2M from 2024 to 2025.

A Masterclass in How a Non-Banking Fintech Launches a Banking Service

Most fintechs struggle to pivot into full banking services because they lack direct deposits, credit lines, and full customer financial engagement. Robinhood cracks this problem by using its Gold subscription as a Trojan horse to gradually transition customers from trading into full banking relationships.

Banking features feel like an extension of an existing service rather than a separate product.

Direct deposits and financial tools are integrated into a familiar UI, reducing friction.

No need for expensive marketing campaigns - Gold subscribers naturally explore new financial features.

Subscription model ensures long-term retention, allowing Robinhood to monetise not just transactions, but the entire financial relationship.

With Robinhood Gold as the central gateway, users can trade, bank, invest, and build wealth inside one ecosystem. This seamless transition from fintech to full banking platform is a blueprint for how other fintechs can evolve into dominant financial players.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.