📱🌙 Tabby’s Biggest Month: How Ramadan Drives Record-Breaking Sales in MENA

How Tabby Cracked MENA BNPL - And Why Ramadan Is Now Bigger Than Black Friday

For Tabby, the Middle East’s largest fintech, Ramadan isn’t just another shopping season, it’s the biggest sales surge of the year.

With $43M in sales in just one day, 32% growth in transactions, and peak shopping hours shifting to midnight, Tabby has turned Ramadan into its most important month, driving record-breaking demand for BNPL.

In this article, we’ll cover:

🛒 A brief history on Tabby & meeting its CEO Hosam Arab.

🤩 The Tabby’s Aha moment

🛍️ Why MENA merchants love Tabby, and how Tabby drives higher basket sizes, more conversions, and repeat purchases.

🌙 How Ramadan became bigger than Black Friday for Tabby.

🔢 The data behind Tabby’s billions in transactions during Ramadan and insights like how late-night shopping dominates Ramadan.

one-fs x Dubai Fintech Summit

Some exciting news for one-fs 🎉

one-fs has been selected as an official partner for the 2025 edition of the Dubai Fintech Summit, one of the world’s largest fintech events, hosted in Dubai on 12-13 May and organised by the DIFC.

I couldn’t be more proud of this achievement. In just one year, one-fs has grown into a trusted fintech publication, delivering unique and authentic content week after week.

As a partner for this event, expect exclusive insights, behind-the-scenes coverage, and deep dives into the latest fintech innovations in the coming weeks.

Keep your eyes open 👀

Meet the most valuable fintech in the Middle East: Tabby

With a $3.3B valuation and 15 million customers, Tabby is the poster child of fintech success in the region.

And it didn’t happen by accident.

Before Tabby was launched and before Buy Now Pay Later (BNPL) even existed in the region, I received an email from Tabby’s co-founder, Hosam Arab, requesting a meeting to pitch Tabby at the bank I was working at.

I had already seen Hosam’s impact with Namshi, one of the first major e-commerce platforms in the Middle East, so I knew we had to meet him.

The pitch was immaculate. With his experience, vision, and high-agency, it was clear Tabby was going to be big. But banks didn’t quite get it… their response?

“We already offer instalments with our credit cards.” 😆

Tabby wasn’t alone in its early days - at launch, at least six other local BNPL startups were competing for the same space.

While most saw BNPL as a digital play, Tabby took a different approach based on a deep understanding of the region. Instead of focusing on online payments first, Tabby built its offering around in-person payments, targeting leading physical stores and securing partnerships with two of the biggest UAE shopping conglomerates:

Al-Futtaim & Majid Al Futtaim.

With strategically placed in-store ads on medium-to-high-ticket items, the message was clear:

💳 Pay only 1/4 today, no interest, instant approval in the Tabby app.

The Aha Moment

It worked.

The first time I tried Tabby as a customer, I was purchasing household electronics at Ace Hardware. While waiting in line at checkout, I downloaded the app, entered my ID details, saved my card, and got an instant credit of AED 4,000, all before it was my turn to pay.

I simply told the cashier I wanted to pay with Tabby, scanned a QR code, and one-fourth of the payment was instantly processed.

Talk about an Aha moment - this was it.

Beyond In-Store: A Frictionless Online Experience

With strong brand awareness through its in-store partnerships, customers trusted Tabby, opening the door for e-commerce integrations.

Tabby worked relentlessly to create a slick and ultra-fast checkout experience. Small details like:

➡️ Passing the customer’s mobile number automatically to avoid manual login.

➡️ Triggering an OTP (one-time password) via SMS for seamless authentication.

➡️ Auto-filling the secure code via mobile keyboard integration, no typing needed, just one tap to confirm.

Ironically, I started using Tabby not to split payments, but because it offered a faster checkout than entering card details, especially at stores I’d never purchased from before.

Even today, Tabby allows payments via Apple Pay, even if the store itself doesn’t support Apple Pay.

Tabby Today: The Region’s Most Valuable Fintech Unicorn

Tabby now stands as the Middle East’s largest fintech unicorn:

📈 $3.3B valuation (following a $160M Series E funding round)

👥 15M+ users

💰 $10B annualised sales

🏪 40,000+ merchants

Not bad!

Why MENA merchants love Tabby

Here’s what Tabby promises merchants:

↗️ +33% increase in Average Order Value

Facilitate higher-priced sales and larger basket sizes with interest-free instalments.

↗️ +18% increase in conversion

Reduce cart abandonment and remove pricing barriers, turning browsers into buyers.

↗️ +40% repeat purchase rate

Give customers more reasons to return, making Tabby their preferred payment method.

In certain industries, average order values can increase by up to 180% - as seen with Home Box, a UAE-based home and decor eCommerce platform.

Tabby’s fees:

Tabby is more expensive than traditional card schemes, but merchant adoption proves it’s worth the cost.

💳 Merchant fees: 2-8% (varies by industry).

💰 For customers: Pay in 4 is free, but Tabby+ (Visa card with 5% cashback) costs $13/month.

⏳ Late payment fees apply, except in markets like Saudi Arabia, where they are exempted.

Tabby’s busiest month: Ramadan

Ramadan Kareem 🎉

As of yesterday, Ramadan has officially started. In the Middle East, people of all faiths and beliefs celebrate it - it’s a festive season for all, marked by sharing, gatherings, and generosity.

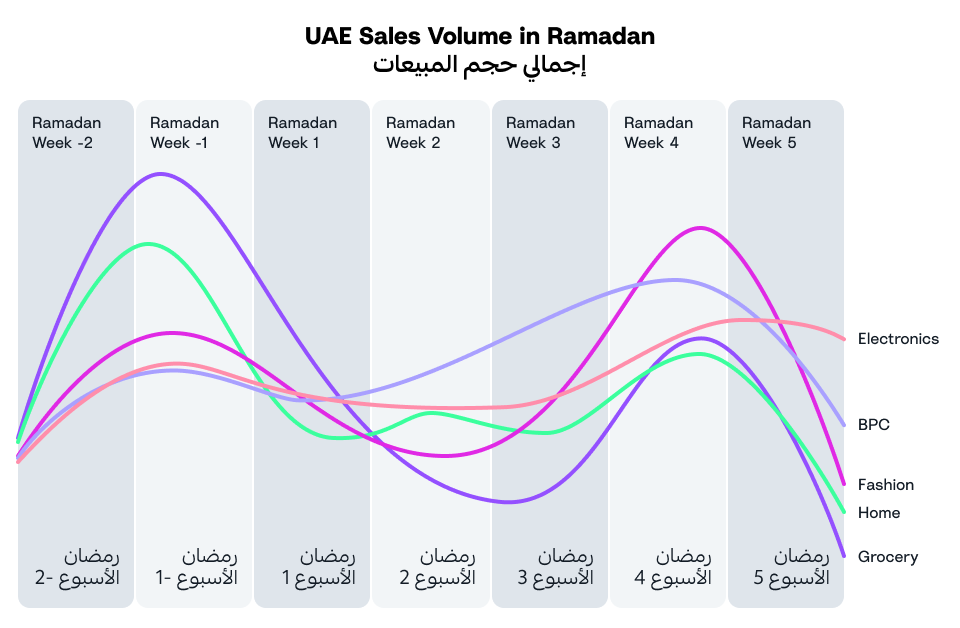

And just like Christmas drives higher sales for merchants in other parts of the world, Ramadan is the peak shopping season in the MENA region.

+32% Uplift in Sales for Tabby

Last year’s data from Tabby showed a staggering 32% increase in sales during Ramadan, outperforming other key events like Black Friday.

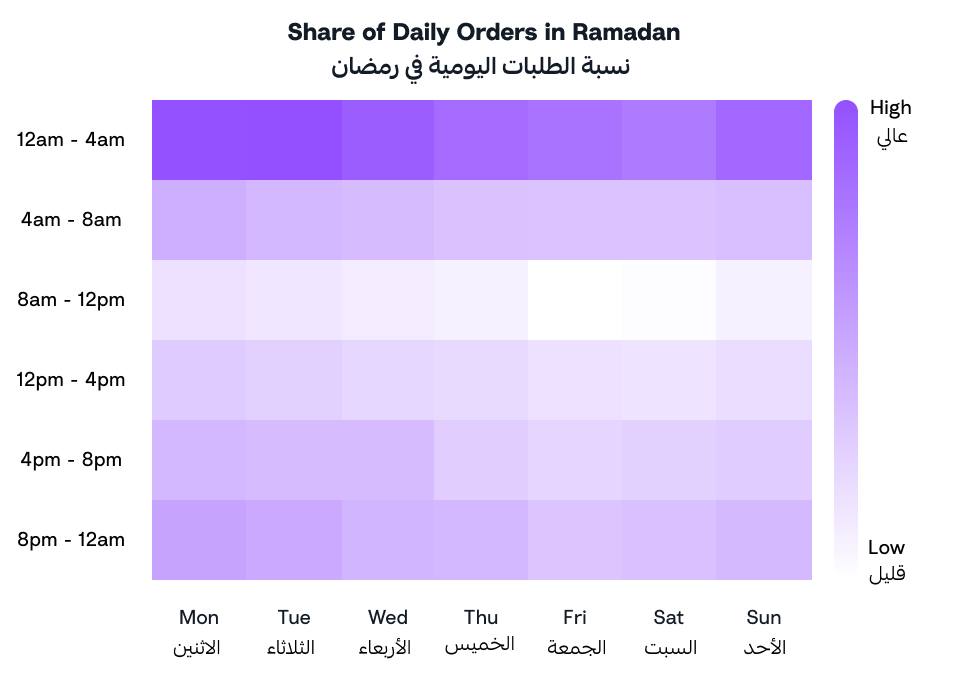

With most activity happening at night, shopping behaviour change dramatically:

🛍️ Peak shopping hours: 12 AM - 4 AM

📅 Busiest days: Sundays, Mondays, and Tuesdays

For merchants in MENA, Ramadan isn’t just a religious occasion, it’s a business opportunity like no other.

$43M of Tabby sales in just one day

At its peak hour on its busiest day, Tabby recorded sales of $43M, with a staggering 58,000 USD per minute.

Having worked in leading e-commerce brands with real-time dashboards tracking sales, I know how surreal these numbers can feel compared to regular sales days.

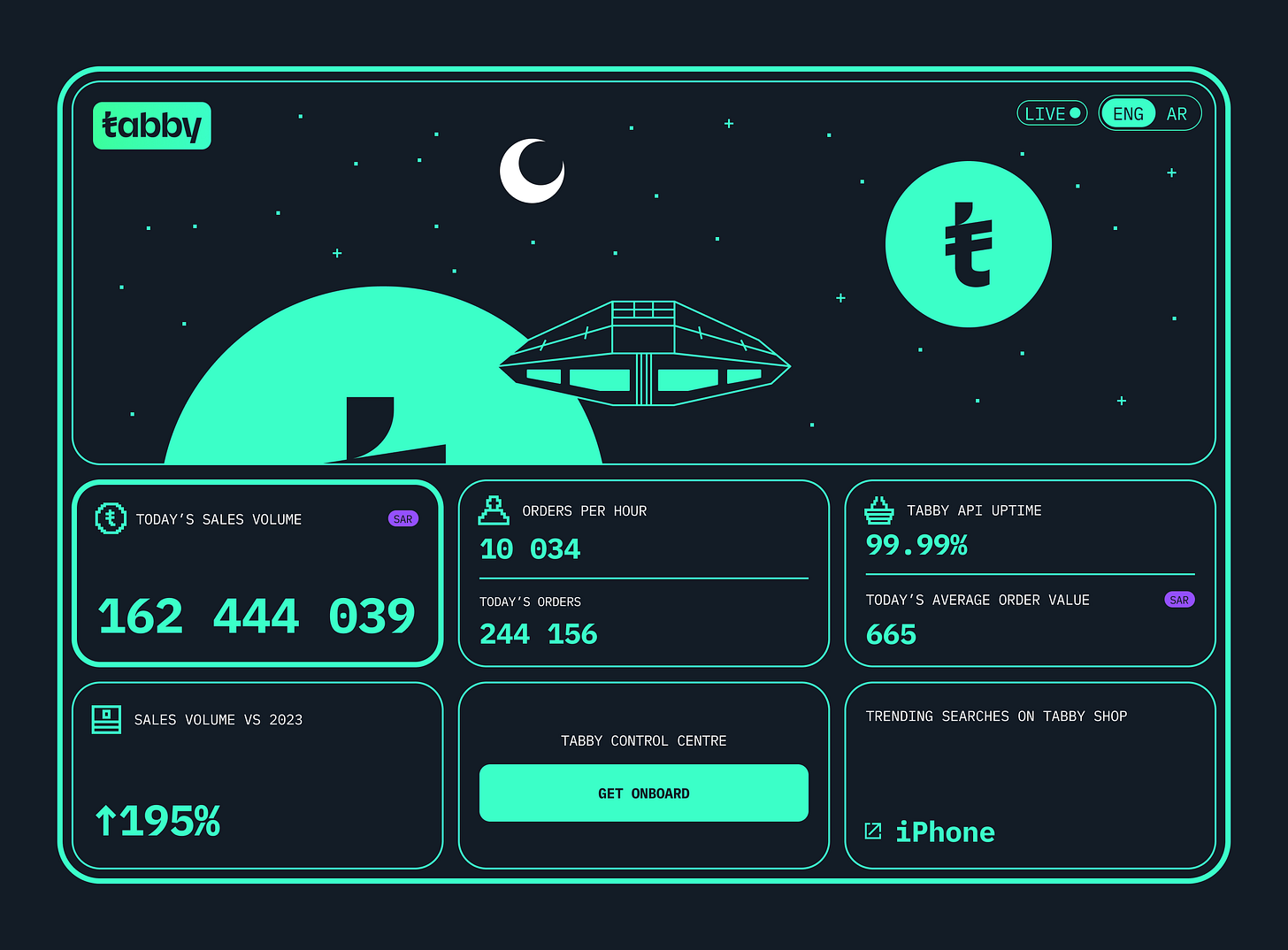

To capture this intensity, Tabby has created a live dashboard (similar to Stripe’s black friday dashboard) to showcase the scale of transactions in real time.

Total sales volume of 43,353,092.87 USD over 24 hours.

During peak time Tabby processed 3,529,602.62 USD in an hour, that’s over 58,826.70 USD every minute.

244,156 orders were processed over 24 hours, that’s over 10,100 per hour.

The average order value on the busiest day of the year was 177.48 USD.

iPhone was the most searched item on Tabby Shop.

There was an 195% increase in Tabby sales compared to Ramadan 2023.

Maintained a 99.99% API uptime.

Source: Tabby

I’m curious to see what the 2025 edition of the Tabby live dashboard has in store for us!

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.