🇸🇦🪙 The New Saudi Riyal Symbol and the Future of GCC Currencies

What the Riyal’s Facelift Means for Fintechs, Digital Payments, and the Evolution of Money in the Gulf

Currencies aren’t just about transactions—they’re symbols of national identity, economic strength, and financial innovation.

Last week, we explored the rise of stablecoins and programmable money following Stripe’s acquisition of Bridge. If you missed it, catchup here, and if you’re keen to explore more on digital currencies, check out money 2.0 - easily explained.

This week, we shift from digital-native currencies to a nearly 100-year-old currency getting a modern facelift: the Saudi Riyal.

In this article, we’ll cover:

🇸🇦 Why Saudi Arabia is introducing a new currency symbol, and what it replaces.

➡️ The challenges fintechs and digital banks face in integrating the new symbol.

🔎 Full guidelines and downloadable assets, including a custom font I built

🖼️ The broader conversation: Does the GCC need a unified currency?

✨ How projects like Aber pave the way for digital payments in the region.

Meet the new Riyal

As I was writing up for this week’s one-fs release, a company Slack message landed: SAMA (The Saudi Central Bank) is launching a new currency symbol for the Saudi Riyal.

I check the guidelines - it looks good. The symbol feels modern and similar to other world currency symbols like $ ¥ €, while drawing its inspiration from Arabic calligraphy to connect with Saudi’s culture. Bridging old and new with one symbol.

“The Saudi riyal symbol represents the national currency of Saudi Arabia and marks a strategic step toward strengthening the Kingdom’s cultural and financial identity. It reinforces the Saudi riyal’s presence regionally and internationally, highlighting the Kingdom’s economic role as a bridge connecting global trade”

SAMA (The Saudi Central Bank)

Although the Saudi Riyal already had a symbol, the ISO 4217 currency code “SAR” (Saudi Arabian Riyal) was most commonly used before the amount, sometimes also abbreviated to “SR”.

The new symbol, made up of Arabic letters from the word Riyal, aims to replace all three representations of the Riyal: SAR, SR, and the old currency symbol.

As I finish reading through the guidelines, the realisation hits: this seemingly small design change is much more complex than it looks.

Let’s get down to it ⬇️

Overall guidelines

If you are a fintech that operates in Saudi Arabia (or is in the process of entering the market), you will be expected to use the new symbol in your product instead of the ISO code “SAR,” the “SR” abbreviation, or the old symbol.

I haven’t seen any exceptions in the guidelines, so it’s fair to assume that whenever a Saudi Riyal amount is displayed, the new symbol should be placed before it, with any other representation of the currency removed.

Since the Saudi Central Bank is coordinating a marketing launch campaign, the new symbol should gain awareness within the Kingdom. However, you may want to reinforce it with your customers to help familiarise them with the change.

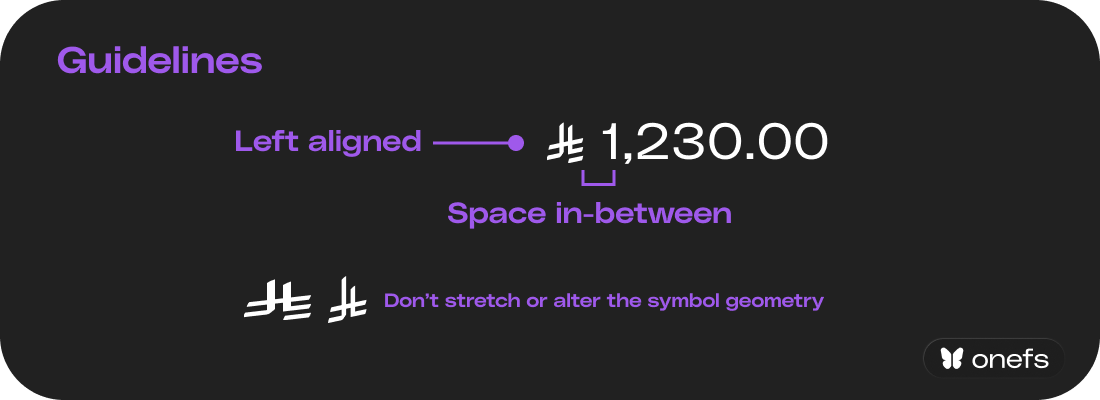

The guidelines are simple:

• Always left-align the symbol to the numerals (even on an RTL layout).

• Keep a space between the symbol and the numerals (previously, “SR” was often displayed without a space before the amount—watch for this).

• Do not stretch or alter the geometry of the symbol (this goes without saying).

The symbol currently comes in one thickness, but it’s expected that font designers will be allowed to create various weights for better integration into different font styles, allowing for more customisation in designs.

⬇️ Here is the official guideline document:

⬇️ And here is the official symbol:

Font support for currency symbols

We often take for granted that currency symbols are readily available in the fonts we use. Pick any Google Font, and you’ll find $ ¥ € included without issue.

This is because fonts rely on Unicode, a globally recognized character encoding standard. Unicode is managed by a consortium that includes tech giants like Apple, Google, Microsoft, Adobe, Meta, and IBM.

When creating a new font, designers map characters to Unicode to ensure systems display them correctly.

💬 The Challenge With the New Saudi Riyal Symbol

Unlike other currency symbols, the new Saudi Riyal symbol is not yet defined in Unicode.

The approval process takes time. The last currency symbol added was the Kyrgyzstani som in 2021.

Even after approval, font adoption is slow. For example, Bitcoin’s symbol was approved in 2017, yet it’s still missing from many fonts today.

➡️ TL;DR: You won’t be able to simply use the new Riyal symbol through your favourite font for a while.

A Quick Fix: The Custom SAR Font 🎉

Since my company operates in Saudi Arabia and is regulated by SAMA, we needed a fast and scalable solution to update thousands of product screens, as well as around 200 marketing artworks displaying SAR.

The easiest solution? A text-based replacement.

➡️ Instead of embedding an SVG and updating APIs, I created a custom font that allows us to swap out “SAR” for the new Riyal symbol.

How It Works

The custom font contains only three characters: S, A, and R.

S & A are blank, while R contains the new symbol.

When assigned to the SAR letters, the new symbol automatically appears—without changing the UI structure.

If the font fails to load (e.g., in emails), SAR remains as a readable fallback.

This quick workaround ensures seamless integration while we wait for official Unicode support.

Note: it is also possible to add the symbol in your existing font, not as an official currency symbol but by adding it as a custom character. But for this you might need the help of a typographer.

You can download the custom font here:

Be sure to forward this email to your design & engineering team. It will save them hours of work. 🚀

Local currencies in the GCC

After last week’s edition on stablecoins and there advantages, I keep wondering about the future of digital currencies in the GCC. Could a unified digital currency work in the region?

Each GCC country (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman) has its own currency, and all (except Kuwait) are pegged to the US dollar. But does it make sense for small countries like Bahrain (roughly half the size of London) to operate their own currency?

Even combined, the entire GCC GDP is lower than the UK’s GDP.

The idea of a common GCC currency isn’t new. It was proposed in 2001 to create a single monetary union, similar to the Eurozone.

However, the project stalled due to loss of economic sovereignty (some countries prefer to keep control over their interest rates and monetary policy) and disagreements over the central bank’s location.

Project Aber – A Step Toward Digital Currency?

Despite these setbacks, the UAE and Saudi Arabia launched Project Aber, a blockchain-based digital currency experiment in 2019.

Project Aber was a joint CBDC (central bank digital currency) pilot designed to test the feasibility of a shared digital currency for cross-border transactions between the two countries.

Key Objectives of Project Aber

Test the Use of a Digital Currency for real-time cross-border settlements between Saudi Arabia and the UAE.

Explore Blockchain and Distributed Ledger Technology (DLT) for secure, transparent, and efficient payments.

Reduce Costs and Settlement Times by eliminating reliance on traditional correspondent banking.

Improve Financial Stability by creating a direct interbank payment system.

Lay the Foundation for a Wider GCC CBDC, potentially expanding to other Gulf countries in the future.

How It Worked

The project tested a dual-issue CBDC, meaning the currency was jointly issued by both the Saudi Central Bank (SAMA) and the UAE Central Bank (CBUAE).

The Aber digital currency was used exclusively for transactions between commercial banks in both countries—not for public use.

A permissioned blockchain was used to facilitate transactions while maintaining security and compliance.

Key Findings & Results

✅ Blockchain was effective – The system successfully processed real-time cross-border transactions between Saudi and UAE banks.

✅ Reduced Costs – Transactions were cheaper and faster compared to traditional banking systems.

✅ Secure & Transparent – The distributed ledger ensured high security and full traceability of transactions.

✅ Scalability Potential – The technology could be expanded to other GCC countries.

❌ Regulatory Challenges – Full-scale implementation would require significant regulatory harmonisation across the region.

Although Aber was only a pilot and has since concluded, it provided valuable insights for newer digital currency initiatives. Both Saudi Arabia and the UAE continue to explore digital payments and blockchain-based financial solutions, paving the way for potential future adoption.

About Dom Monhardt, founder of one-fs.com

I am a French technologist and product leader living in Dubai, with 15+ years of experience in building cutting-edge and innovative digital experiences.

I am interested in the intersection of business, design, and technology and am deeply passionate about the fintech and digital banking world.